Are you entitled to R&D tax relief?

Sep 2020

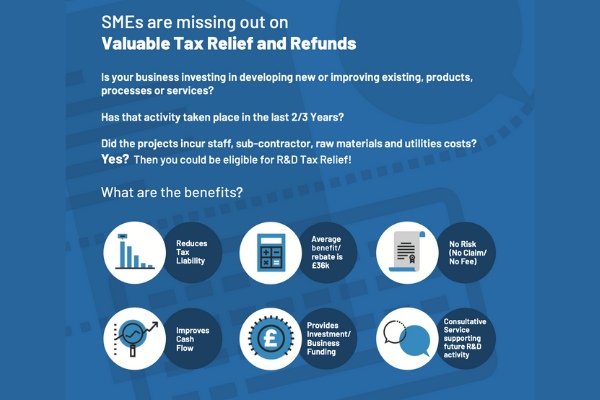

So many businesses are missing out on vital Research and Development tax relief & refunds. The government initiative was set up to reward innovative Limited companies by giving money back for the costs incurred for R&D activity they undertake within their business.

Research and Development tax relief is a Government initiative set up in 2000 to reward innovative Limited companies by giving money back for the costs incurred for Research and Development activity they undertake within their business. Qualifying costs include staff costs, software, utilities, subcontractor or outsourced costs as well as materials used.

A misconception that has been held for many years is that you have to be a Scientist in a Lab to be undertaking R&D activity and therefore, be able to make a claim. Not so, any limited company that is developing New OR, Appreciably improving, Product, Process, Software/ Systems Materials or Devices may be entitled to make a claim.

A short telephone call will also determine whether or not you qualify. We work closely with Gary and can highly recommend Innovation Relief. Its definitely worth a call!

Call Gary Johnson on 07785 555515 or email [email protected]

Have a watch of this informative video….